Internet Redemption Methods

TABLE OF CONTENTS

Introduction

This only applies to customers who have purchased the Merac online ticketing module, as the following document explains the three ‘Internet Redemption Method’ options that are available. These relate specifically to online bookings made on our Merac e-commerce ticketing web pages only. If you are interested in having our online ticketing pages then please contact your Account Manager for more information and a quote. The three redemption methods that are detailed in this guide are:

- Deposit Mode

- By Item Mode

- Redemption Mode

The configuration requirements and explanation of the differences between each of these methods and how they function is explained in detail in this document.

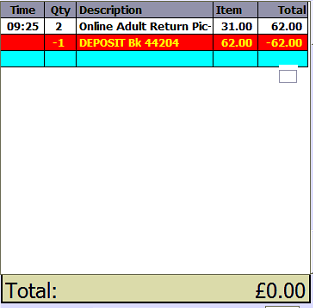

Deposit Mode

In this mode, all internet bookings will be processed as a single PLU. Bookings will be saved in Merac under the correct resource. Items sold online will be made up of different VAT codes. Normally the VAT is set to ‘Zero’ or ‘Outside Scope’. The final VAT will be calculated when the booking is redeemed, and the real PLU’s are processed the deposit is reversed out.

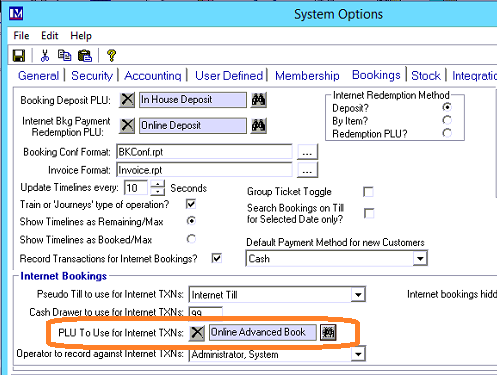

A PLU is created and set within the system options:

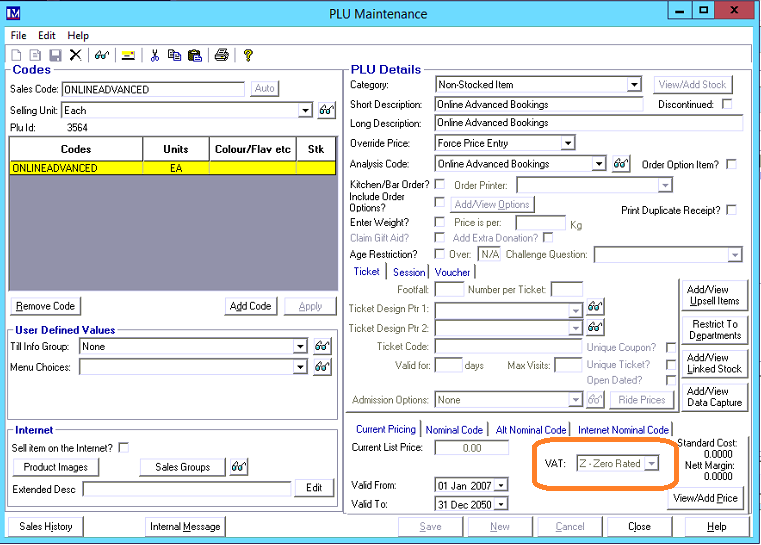

An example of the PLU that is created and set in the ‘System Options’ is shown below.

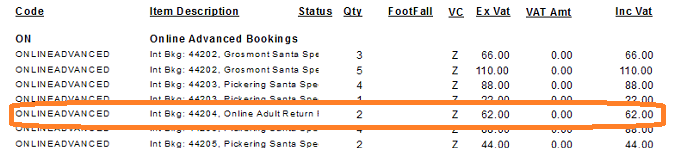

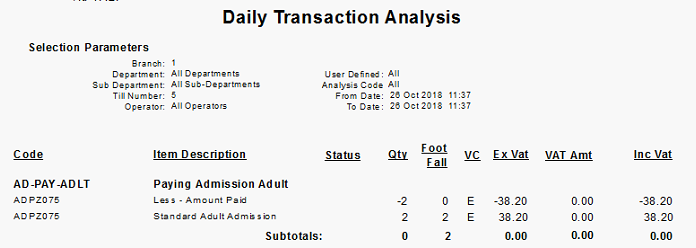

The transaction reporting will show the same PLU but because the description will differ for the booking reference, it will split into different lines. Examples of the the transaction lines appear for this redemption method are given below:

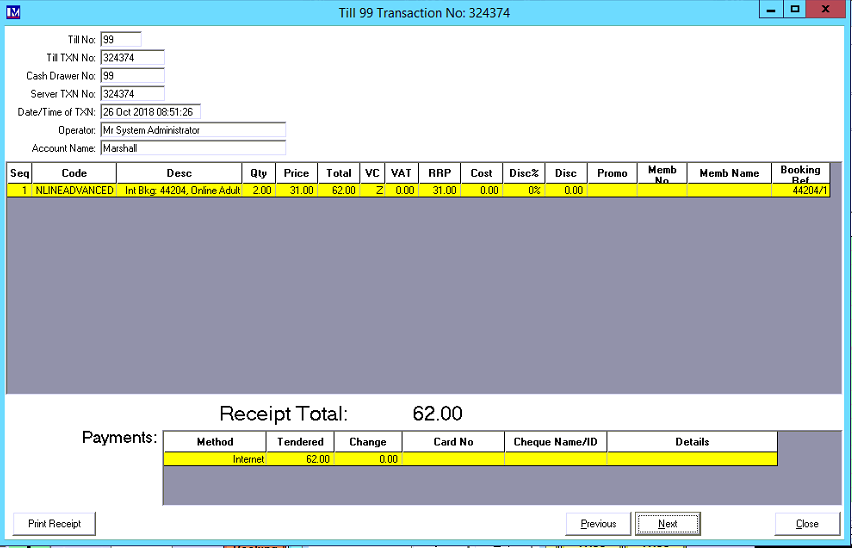

When recalled to a till it will process the correct PLU, record footfall, print tickets and complete the booking. It will reverse the deposit paid; the transaction balance will be zero. Revenue will increase for the ticket sales but reduce for the deposits. Completed bookings will no longer appear on the deposits held reports.

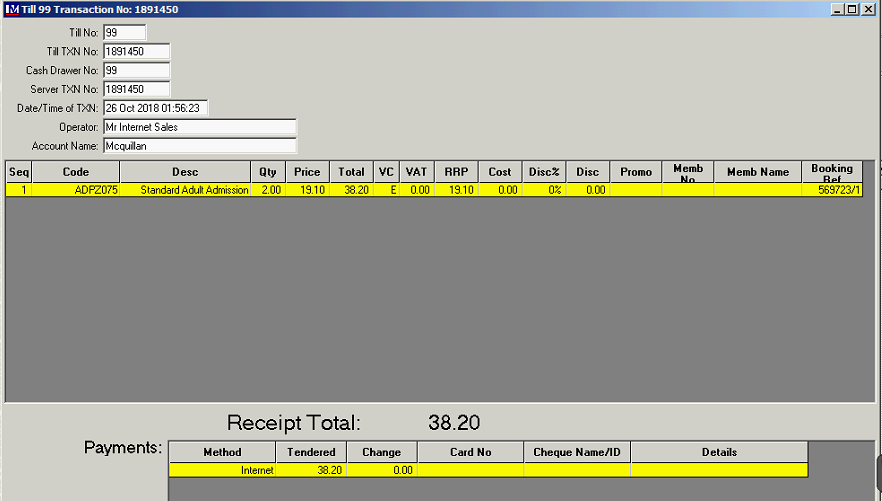

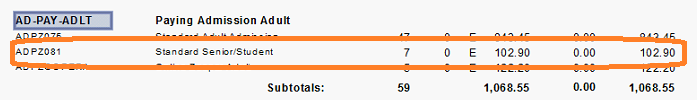

By Item Mode

In this mode, all internet bookings will be processed as the real PLU’s that are linked to the ‘Bookable Resources’. The footfall will not occur until they arrive and complete the booking. The Gift Aid and tax will be processed at the time that the booking was made, and the transaction was recorded.

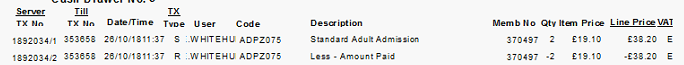

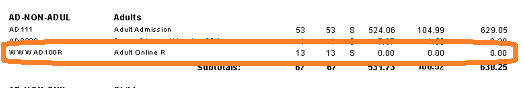

It will appear on the transaction reports as the real items. You can run the report based on “in-house” or “online” tills, but if you did not specify then the two would be added together. Examples of the the transaction lines appear for this redemption method are given below:

N.B. if the “online” and “in-house” sales need to be seen side by side, then separate PLU’s can be made to sell the products online (i.e. a different set of PLU’s to those used to sell the products “in-house” need to be set up and used to sell the products “online”).

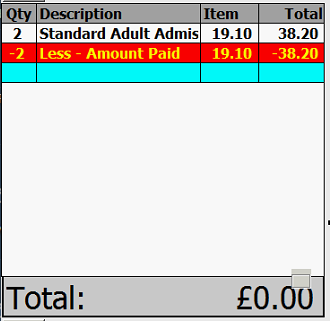

When the bookings are redeemed, the till will refund out the amount already paid under the same barcode with the ‘Description’ “Less – Amount Paid” for each of the booking lines. The footfall will happen at the time of completion and any tickets will print.

The items will be side by side on the reporting (as they are the same codes) and will balance out so no revenue increases.

Redemption Mode

In this mode, all internet bookings will be processed as the real PLU’s that are linked to the ‘Bookable Resources’. This mode is very similar to the “By Item” mode. The system will sell the PLU; however, the difference will occur at the time the booking is completed. Please note this mode was developed for and generally only used by one specific customer, so the other two methods are the ones used by the majority of customers with the Merac Online Ticketing pages

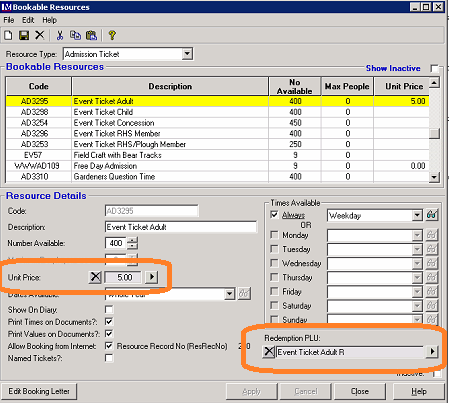

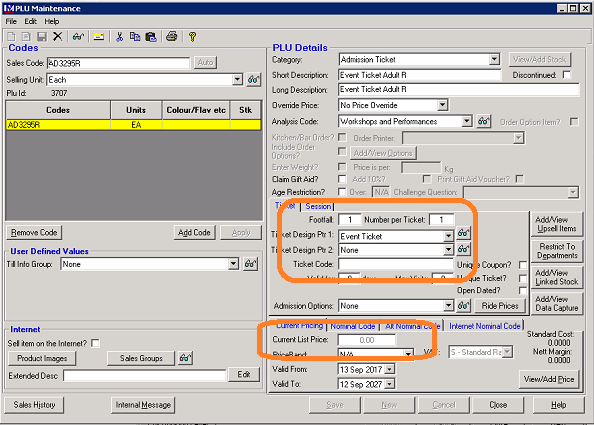

On each of the bookable resources there will be an extra section where a second PLU is set which will be the one used when the booking is completed.

The first PLU set will be the price for the sale, the second is the redemption PLU which is used when the booking is completed at the till. The second PLU will be where the footfall and the tickets are set, as this PLU will be recalled to the till and print the tickets.

- The reports will have a split between the sales and the redemptions as they are different PLU’s.

- There will be no reversals of any products.

- The VAT and Gift Aid will be processed at the time of the booking and transaction was recorded.

By grouping the redemption PLU’s into different ‘Analysis Codes’, you can split sales and redemptions into different groups for reporting purposes.

Please note:

The above only relates to online bookings only. All “in-house” deposits (taken at a till) are processed by “Deposit Mode” only. “In-house” deposits may need to be a percentage or a set amount ahead of time to secure bookings. For this reason, only “Deposit Mode” can support taking a set amount as part payment, without needing to sell a fraction of a ticket to take a deposit and have an issue with rounding and how it would look on receipts and invoicing.